Authors: Anna Gincherman, István Szepesy, Laura Trueba

Partners: IDB Invest

Year: 2023

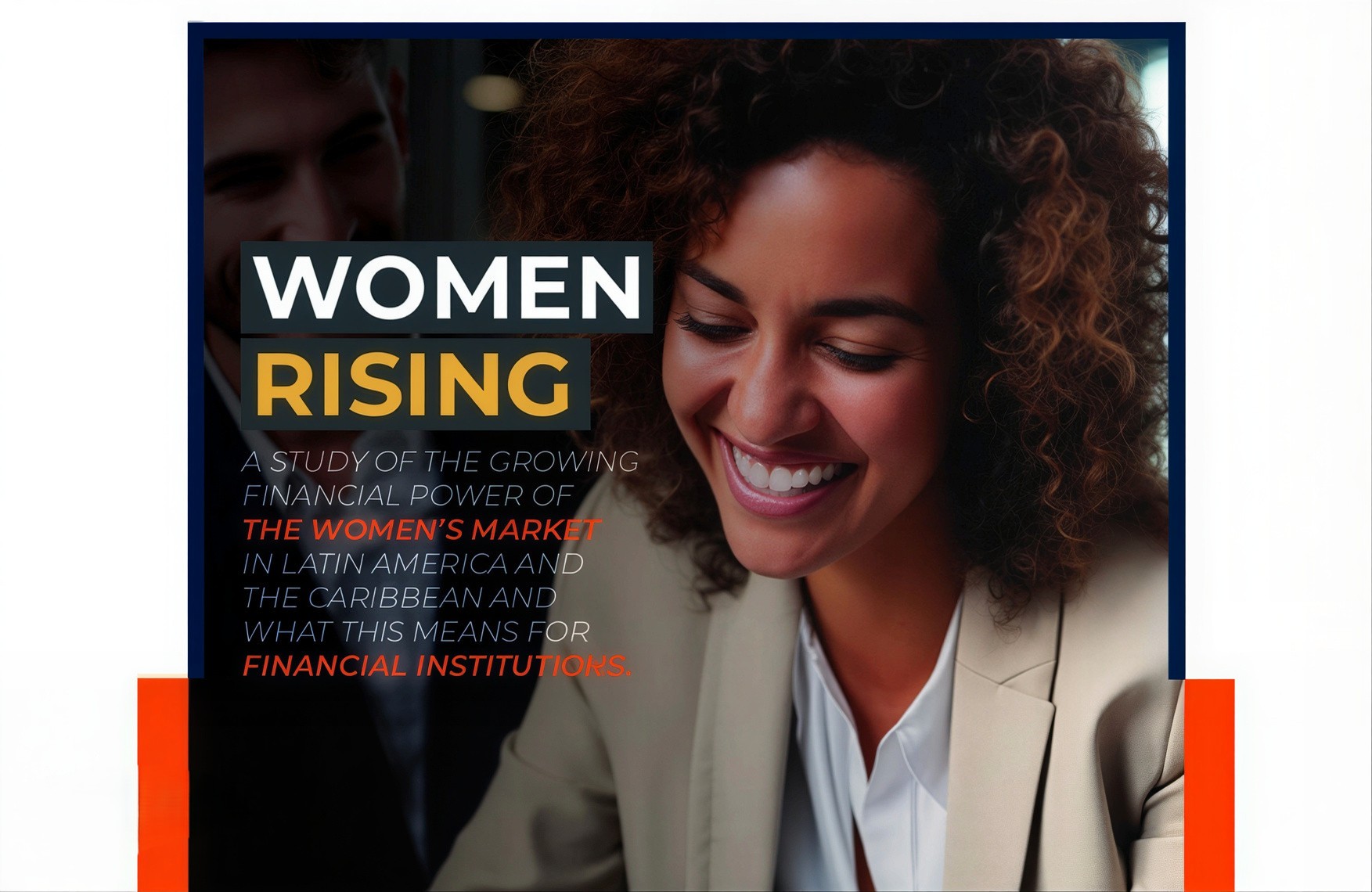

Across Latin America and the Caribbean, women are becoming an increasingly influential force in household finances, entrepreneurship, consumption, and the broader economy. Yet financial institutions often underestimate the size and potential of the women’s market or treat it as a single, uniform group.

Across Latin America and the Caribbean, women are becoming an increasingly influential force in household finances, entrepreneurship, consumption, and the broader economy. Yet financial institutions often underestimate the size and potential of the women’s market or treat it as a single, uniform group.

“Women Rising: A study of the growing financial power of the women’s market in LAC, and what this means for financial institutions” examines how women across Latin America and the Caribbean are shaping the region’s economies as earners, consumers, savers, and business owners. Their financial influence continues to grow, yet many institutions still overlook the size and complexity of this market or treat women as a single segment. The study unpacks these dynamics and highlights what they mean for providers aiming to serve women more effectively.

The publication looks at the demographic, behavioural, and economic trends behind women’s rising financial power. It explores shifts in employment, income generation, household decision-making, and entrepreneurship, as well as the persistent barriers that limit women’s ability to access and benefit from financial services. The research illustrates how these factors translate into a wide range of financial behaviors and needs across different groups of women in the region.

The findings point to a market that is both significant and diverse. While women in LAC are advancing educationally and economically, many still navigate challenges related to informality, income volatility, caregiving responsibilities, and limited access to tailored business support. These factors create distinct customer segments and clear opportunities for financial institutions to design more targeted value propositions that respond to women’s real financial journeys.

Developed by ConsumerCentriX on behalf of IDB Invest, Women Rising offers evidence-based insights that can support institutions looking to grow sustainably while strengthening inclusion. ConsumerCentriX contributed to the research and analysis, helping bring greater clarity to the women’s market in LAC and the strategic opportunities it represents for the financial sector.