Who We Are

Our History

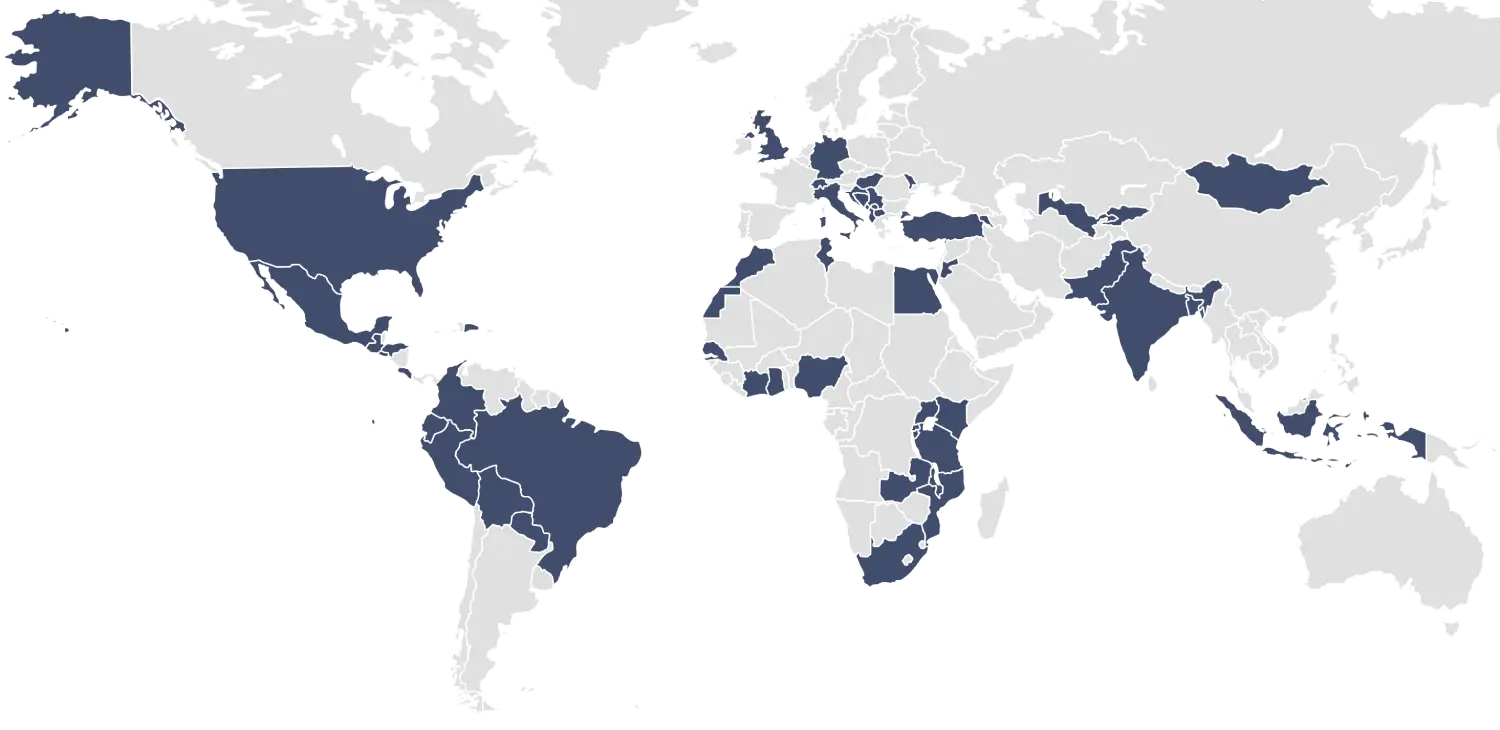

ConsumerCentriX was founded in 2012 by Daniel Arnold to support industry and innovation leaders around the world with strategy and innovation grounded in customer insight. Our work is rooted in ValueDNA, a proprietary approach to psychographic research and segmentation that informs strategy, product innovation, and communication. Over time, ConsumerCentriX expanded its focus into financial services and entrepreneurship in emerging markets, building recognised expertise in gender-intelligent finance, MSME banking, and practical digital solutions for unbanked and underbanked populations. In 2019, we launched CCX Inclusive Business to deepen our focus on financial inclusion, supporting partners across the ecosystem, including multi-national development partners, donors, regulators, and financial service providers. To date, we have implemented over 80 projects in more than 60 countries, working with over 100 development and implementation partners.

Our Strategic Aim

We are committed to developing scalable, evidence-based solutions grounded in a deep understanding of the lives, needs, and constraints of unserved & underserved populations in emerging markets.

Through our work, we strive to foster inclusive growth and build equitable financial ecosystems that empower these communities and enable sustainable economic participation.

Our team applies rigorous analysis and sector expertise to design solutions that strengthen the connection between unserved & underserved communities and equitable financial services. We combine empirical research, innovation, and sector expertise to advance gender-intelligent finance, SME banking, regulatory and policy dialogue, entrepreneurship, and digital financial solutions.

Together with our partners we build financial ecosystems where women entrepreneurs, youth, as well as micro, small and medium-sized enterprises (MSMEs) can thrive, through tailored financial and non-financial services that respond to their needs.

What Drives Us

How We Work

At ConsumerCentriX, we help financial service providers and ecosystem stakeholders design and deliver solutions that expand access to finance, especially for underserved and underestimated segments such as women entrepreneurs, youth, and MSMEs.

Our approach is built on four principles:

We Ground our Work in Evidence

We combine quantitative and qualitative research to understand what customers actually need, how they make financial decisions, and what gets in the way of uptake and use. This ensures our recommendations are practical, actionable, and rooted in real customer realities.

We Design Solutions that Fit the Context

What works in one market may fail in another. We take time to understand the operating environment including institutional capacity, customer behaviour, and regulatory conditions and translate insight into solutions that can be implemented within real-world constraints.

We Apply a Gender Lens that is Practical

Our gender work is based on evidence, not assumptions. We help partners understand how women and men experience financial services differently, then turn those insights into product, channel, and customer engagement improvements that lead to better outcomes.

We Bring Cross-sector Insight to Financial Services

Our team draws on experience across consumer-facing industries. This helps us identify patterns in customer needs and behaviour, and apply proven approaches from other sectors to improve how financial services are designed, delivered, and adopted.

OUR MISSION

Our mission is to develop scalable solutions that are based on deep insights into the lives, needs and constraints of un/underserved people in emerging markets to improve their livelihoods and create opportunities for economic growth.

Do you share the same goals?